Visualizing American Express' Transfer Bonus History

I am a big fan of time bar-based visualizations, such as the timeline view in ITA Matrix. I think it it easier to intuitively understand how things are arranged in time relative to each other compared to looking at a printed timetable. A few months ago, I was interested in when the next American Express transfer bonus to Virgin Atlantic was, because I was interested in booking tickets on Delta’s flight from Nagoya to Detroit. The transfer history is available on the internet, but it is difficult to see recurring trends. At the time, I drew it on paper, but since I have some time on my hands now, I decided to make it into a web page.

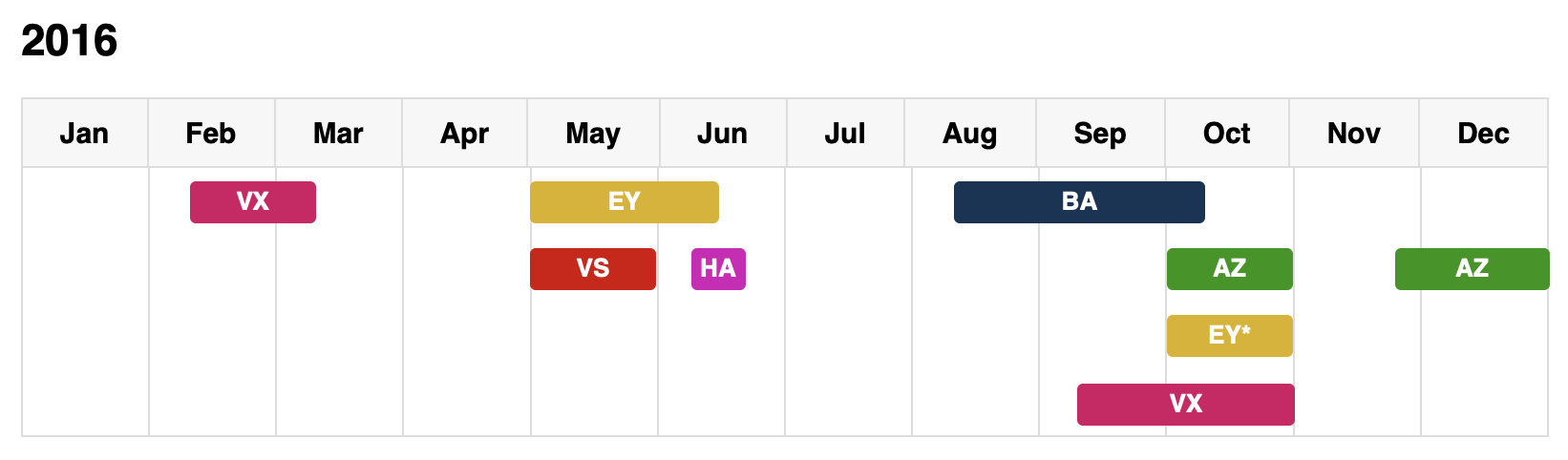

It is available here, but if you don’t want to tear your eyes away from this blog post, it looks something like this:

I only went back as far as 2016 becuase there are several trends that seem to not hold since then. I noticed a few interesting trends:

- There are rarely transfer bonuses in the first few months of the year – likely because most people are booking summer vacation travel with points during those months and they don’t need an additional incentive to transfer their points and remove the liability from American Express’ balance sheet.

- There are often bonuses before the end of the year, again likely to clear the liability and because the frequent flyer programs likely get more interested in making the numbers look good before they close the books on the year, and before the slowest travel month of January.

- Recently a transfer bonus to Virgin Atlantic has immediately followed a transfer bonus to Flying Blue, and the bonus for Virgin Atlantic usually overlaps with a JetBlue transfer bonus.

Points 1 and 2 make me interested in who is funding the transfer bonus – does Amex pay more to generate interest in its credit cards, or do the carriers offer periodic discounts to increase revenue, or both? Given that the common players recently (Virgin, Flying Blue, and Avios) partner with all of the major transferrable currencies (Amex, Chase, Citi, Capital One, and Marriott), my suspicion is that those programs sell their miles for a very attractive price that makes it very easy for banks to add them as a transfer partner. On the flip side, those programs also likely find the banks purchasing points to be a valuable component of their revenue.

There’s another trend that I notice that I know the answer to. Delta, the largest and closest airline partner of American Express, has not had a transfer bonus since 2011. When Amex lost Costco’s co-brand deal, they rushed to re-up their deal with Delta, at the time their largest partner. I infer that Amex paid through the nose for that deal, so there is no additional room for a transfer bonus. Additionally, many people do not realize the ability to book domestic tickets with partner frequent flyer programs, and just assume Delta’s price in miles is the price.

Incidentally, I did take advantage of the 30% transfer bonus to Virgin Atlantic in December, and managed to book two one-way seats on NGO-DTW for 46,153 membership rewards points and about $50 in taxes each. Delta wanted to charge 300,000 miles for a one-way ticket. Hopefully Japan has re-opened its borders by August…